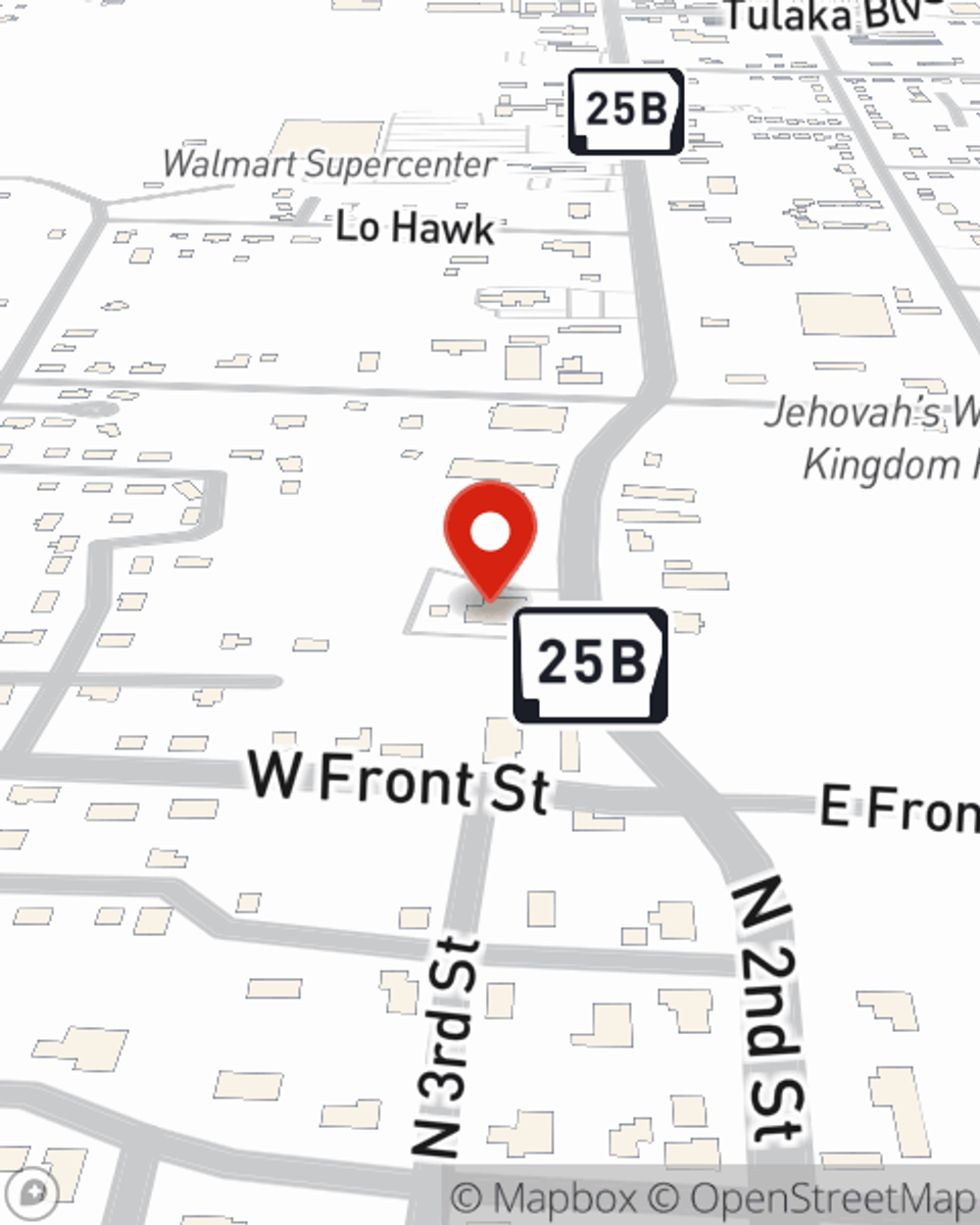

Auto Insurance in and around Heber Springs

Heber Springs's top choice for car insurance

All roads lead to State Farm

Would you like to create a personalized auto quote?

Insure For Smooth Driving

When you’re out and about, anything can happen. Because falling objects or cracked windshields can happen to anyone, anytime, you need car insurance coverage you can rely on.

Heber Springs's top choice for car insurance

All roads lead to State Farm

Your Search For Auto Insurance Is Over

Even better—budget-friendly coverage from State Farm is possible for a wide array of vehicles, from pickup trucks to SUVs to sedans to smart cars.

But the coverage doesn’t stop there. Did you know State Farm also covers camping trailers, snowmobiles, jet skis and truck campers?! With State Farm Agent Brent Brainerd, a policy can be aligned to your assortment of vehicles as well as your situational needs to include options like car rental insurance and Emergency Roadside Service (ERS) coverage.

Have More Questions About Auto Insurance?

Call Brent at (501) 362-5891 or visit our FAQ page.

Simple Insights®

How long can kids stay on parent’s insurance?

How long can kids stay on parent’s insurance?

Learn when a child can transition from their parent’s insurance to their own by understanding various insurance coverage guidelines.

Pedestrian safety tips

Pedestrian safety tips

Pedestrian safety is achievable with these simple steps to keep you and your loved ones safe whether you’re walking or behind the wheel.

Brent Brainerd

State Farm® Insurance AgentSimple Insights®

How long can kids stay on parent’s insurance?

How long can kids stay on parent’s insurance?

Learn when a child can transition from their parent’s insurance to their own by understanding various insurance coverage guidelines.

Pedestrian safety tips

Pedestrian safety tips

Pedestrian safety is achievable with these simple steps to keep you and your loved ones safe whether you’re walking or behind the wheel.